Early this week, one of our members got a chance to use a Christmas present, a $50 gift card, to Outback Steakhouse. He shared dinner with someone special, and the night went pretty smoothly. They got the bill for $46.39 and handed our waiter the gift card. The waiter returned the receipt confirming the charge, and a $10 tip was left in cash.

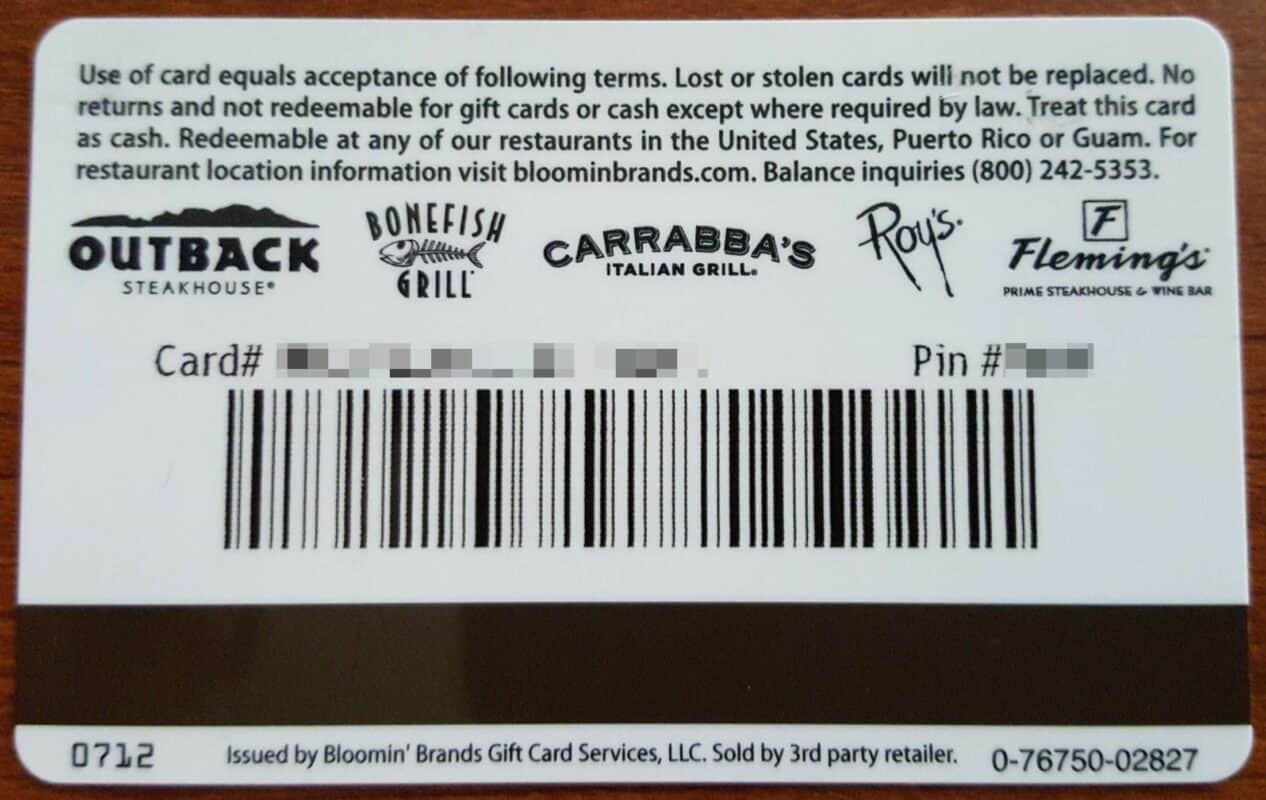

Fast forward a couple of days. The member forgot the exact balance and wondered if trying to use the remaining balance would be worth it.

So he fired up the website to check the balance, and this is what he saw:

Yep, his waiter added a second charge after the meal to clear out the gift card, effectively turning the 21.5% tip into a 29.3% tip. The crazy thing is, he expected this to happen. When he saw the balance, he said aloud, “Of course he did.”

Interestingly enough, the only reaction to this was asking himself a simple question: “What can I learn from this?”

A natural response might be to say, “Oh God, gift cards aren’t secure! Anyone can use them at any time. Don’t buy gift cards; you’re throwing away your money.” But the reality is the existence of gift cards is an economic phenomenon.

It’s quite the conundrum that no one seems to want gift cards, yet gift card sales have steadily grown since 2004, earning roughly $100 billion annually.

Some people call for the death of gift cards, yet the industry is still alive and kicking. Does this sound like anything we’re familiar with in the IT world? BYOD? The Cloud? This brings to mind a specific quote from Victoria Ivey on Cloud Logic:

“Many recommendations across the Net sound like this: ‘Don’t keep your information on the cloud.’ Fair enough, but it’s the same as if you asked, ‘How not to get my house burned down?’ and the answer would be, ‘Do not have a house.’ The logic is solid, but a better way to translate such advice is, ‘avoid storing sensitive information on the cloud.’ So if you have a choice you should opt for keeping your crucial information away from virtual world or use appropriate solutions.”

Victoria Ivey, CIO.com

“That won’t last,” says the vocal minority.

Besides the obvious FUD observation, there are a few lessons to glean from this happening:

- If a move is made to a less secure method (i.e., buying a gift card with a credit card), can we really get mad for getting dinged?

- Let’s say it’s wrong (it definitely is). Then what? Is it worth going through all the trouble to get a little less than $4 back?

- From a business/asset management standpoint, is a 7.2% loss acceptable when we have already received the benefit of the transaction?

And that’s without really getting into any risk management principles.

Honestly, he’s not bent out of shape over this. The food was good, minus the stale bread, and the waiter was super friendly. Maybe this was the universe’s way of telling him he should have left a 30% tip. Or maybe we’re just being ridiculous.

Either way, use your gift card for your meals before your waiters take the balance for their own benefit.

So tell us, do you think this response is appropriate? How would you have handled it differently? Do you have other lessons that can be gleaned from this?