Everyone should have a handle on the kind of documents they should save and those that can be discarded. As you progress through your life and career, your financial documents start piling up in your home office. It’s only a matter of time before you cross over into hoarding territory.

Knowing what and when it’s time to shred those unneeded papers can be a challenge. After all, some important records should be kept for an extended period, while others can go as soon as they’ve served their purpose.

It’s important not to keep documents longer than necessary because this increases the risk of identity theft or other security issues. But practically speaking, it’s important to understand how long to store different types of financial paperwork and in what format to protect yourself and your family without worry!

Read on to learn how long to keep your financial documents for maximum organization and security with these 6 easy-to-follow frameworks!

- What to keep forever.

- What to keep long-term for 7 years or more.

- What to keep for 3 to 7 years.

- What to keep for a year or less.

- What to immediately discard.

- How to securely store what you keep and what and how to destroy.

Table of Contents

How Long To Keep Your Financial Documents

You no longer have to wonder how long to keep your financial documents, personal records, and other important paperwork.

Here are the frameworks for how long and why you should hold onto certain documents.

Keep Forever

You should keep documents relating to the following 2 categories for life:

- Personally Identifying or Vital Information

- Taxes, Investments, or Other Financial Information

Personally Identifying or Vital Information

Personally identifying or vital documents leave little room to guess who they pertain to. Find them, collect them, and protect them. They include the following:

- Academic records

- Adoption papers

- Baptismal certificates

- Birth certificate

- Death certificate

- Divorce papers

- Employment letters (agreements, performance reviews, etc.)

- Government-issued ID cards

- Marriage certificate

- Military records

- Passport

- Social Security card

If you don’t keep these items safe, you risk becoming a victim of identity theft and going through the bureaucratic process again to get them back.

Check out the Identity Theft Prevention Resources by State for more information.

Taxes, Investments, or Other Financial Information

Taxes, finances, investments, and your estate are important to gather and protect. They include the following:

- Bank account information (routing numbers, account numbers, passwords, etc.)

- Beneficiary forms

- Defined-benefit plan

- Inheritance records

- Legal filings

- Life insurance policies

- Powers of attorney

- Retirement plans

- Tax payment history

- Tax returns (electronic or hard copy)

- Wills (estate planning documents)

If your loved one or other beneficiaries need to access any part of your estate after you die, you’ll want to keep these safe.

Next up, we’ll review the length of time for other categories and close out with proper ways to keep these documents safe for as long as possible and how to dispose of them properly.

Keep For 7 Years Or More (Long-term)

Whether you own an asset, have a loan, or use financial products, keep these records long-term until you hit the target completion date.

- Home Information. Keep receipts related to home services, home appliances, home remodeling projects, and other domestic items if relevant to the home for as long as you are the homeowner.

- Home Leases. If you are a renter, keep records of all paperwork, including lease, move-in reports, inspection reports, work orders, and more, until you’ve moved out and have received your deposit back from the landlord.

- Loan Repayment Information. Hold onto loan documentation until they are paid off. This includes loans like your mortgage, car loan, and student loans. For cars, maintain your title until you sell it.

- Products Under Warranty. Keeping the documents for things you’ve bought or insured is essential. To be on the safe side, it’s recommended to keep them a little after the warranty ends. This includes titles, deeds, insurance policies, warranty documentation, and more.

- Insurance claims. Don’t toss those health insurance docs just yet. They’re a valuable record to keep around for the long haul as long as your coverage is still active. Once your coverage is over or you’ve switched companies, it’s safe to say goodbye to the paperwork. This also applies to any disability or unemployment benefits you may receive. Hang onto the documentation until you’re sure you no longer need it. It’s better to be safe than sorry here.

- Financial Products. Hold onto other helpful information about your finances and investments, like CDs, stocks, bonds, and mutual funds. Retain your purchase confirmations until you sell them so that you can establish your cost basis and holding period.

Some of these items can impact your credit score, which can remain on your credit report for 7 years.

Keep For 3 to 7 Years

The documents you should hold onto for up to 7 years involve your taxes. Shocking, we know.

The Internal Revenue Service (IRS) suggests keeping records that can verify your tax information for 3 to 7 years for amendment and audit purposes on your returns. The government has 6 years to collect the tax or start legal proceedings if you fail to report all of your gross income on your tax returns.

The length of time you should keep a document depends on the action, expense, or event the document records. Generally, you must keep records supporting an item of income, deduction, or credit shown on your tax return until the period of limitations for that tax return runs out.

Source: How Long Should I Keep Records by IRS

The IRS provides guidance on supporting tax documents and how they apply to the statute of limitations.

- Keep records for 3 years if you claim credit or refund after you have filed your tax return.

- Keep records for 6 years if you forgot to report income that you should have reported, and it’s more than 25% of the gross income reported on your return.

- Keep records for 7 years if you claimed a loss on worthless securities or bad debt deduction.

- Keep records indefinitely if you didn’t file a tax return or filed a fraudulent tax return.

That’s nebulous. So, what does this mean? This means you should hold onto documents that support your tax return information for 3 to 7 years, including supporting documentation of the following:

- 1099 forms

- Bank statements

- Brokerage statements

- Charity donation receipts

- Dependent care receipts

- Property tax information

- W-2 forms

Keep Supporting Business Info

If you run a business, don’t forget to keep supporting business documents to include records of:

- Gross receipts

- Purchases

- Expenses

- Travel, Transportation, Entertainment, and Gift Expenses

- Assets

- Employment Taxes

Source: What Kind of Records Should I Keep by IRS

Even if your records are no longer needed for tax purposes, you may want to verify that the documents aren’t needed for other important financial institutions.

Before you shred your tax documents, verify their usefulness to related institutions. For instance, your insurance company or a creditor may have different record-keeping requirements than the IRS.

Keep For One Year Or Less

This “keep” category has more of your rolling bills, the month-to-month billing statements. These are the statements you most likely opted in for digital statements, including:

- ATM and deposit receipts

- Bank statements

- Credit card statements

- Insurance statements

- Medical bills

- Pay stubs

- Receipts

- Utility Bills

- Electric bill

- Gas bill

- Internet bills

- Phone bills

- Water bill

Bank records and receipts can help you keep an active eye on your finances just in case there is a discrepancy you need to address. Reconcile bank info and credit card receipts with monthly statements. Save the documents for tax season to support your tax return. Otherwise, shred the documents when you are done with them.

When it comes to utility bills, hold onto them for at least a month after you receive them, just in case. If you are renting your home, we like the idea of saving all bills for your entire stay. That way, you have a complete record of when you stop your service, move, and reconnect your services.

If you’re self-employed or claim a home office space, you may need to save your rent, utility, cable, and cell phone bills for tax purposes. Unless your accountant tells you otherwise, plan to save these for at least a year.

At least keep the statements for investments, insurance, and other medical bills until new ones arrive. That way, you can check for consistency and verify things are getting paid. If you have an unresolved insurance dispute, hold onto your medical bills until the dispute is resolved. Medical bills and insurance are already confusing, so why not keep relevant records on hand to dispute errors?

If you still receive these bills through the mail, consider enabling paperless statements. Not only will this reduce the volume of incoming mail in your inbox, but it will also reduce the risk of identity theft posed by lost or stolen mail.

Immediately Throw away

You can immediately shred these unless you look forward to a particular mailer.

- Catalogs

- Contests

- Coupons

- Flyers

- Loan consolidation

- Pre-approved credit cards

- Publishers Clearing House offers

- Refinancing

- Store marketing and promotions

You can throw away or recycle generic, non-identifying mailers.

How to Store Your Documents

Create a reliable system to store your financial documents safely. Your organizational efforts will also help reduce clutter. The goal is to have storage systems that offer the following benefits:

- Centralized and organized.

- Easily accessible and usable.

- Protected from prying eyes and theft.

- Protected from animal or environmental damage.

Physical Storage

For your important identification and financial information, you should store them somewhere they can exist safely long term, such as:

- Filing Cabinet. Get a filing cabinet, preferably with a lock. You can also store it in a secure room or closet. Use file folders, hangers, and labels to organize paperwork by subject, year, or another workable home filing method.

- Bankers’ boxes can also work temporarily but offer little to protect against prying eyes and environmental damage.

- Personal Safe. Alternatively, you can opt for a solid fireproof, and waterproof safe. You can even go the extra mile to hire a contractor to optimize its hidden location.

- Safety Deposit Box. Your local bank or credit union should have safety deposit boxes available to rent. Fees can range anywhere from $20 to $100s a year for the privilege, depending on the location and size of the box. However, you are at the mercy of the financial institution’s policies and procedures.

Digital Storage

For important digital identification and financial information, securely store them so they are not accessible to anyone but you.

- Encrypted Storage. Whether you store your important files on your computer, an external hard drive, flash drive, or network location, make sure they are encrypted. Encryption is a low-effort item that can give you peace of mind if your device gets lost or stolen.

- Create Backups. It’s a good idea also to back up your data. Just copying your data to an external drive isn’t enough. Create multiple backup copies in case one of them is damaged or fails. Consider the 3-2-1 method for doing this properly. Not to be confused with the grilling ribs method, the 3-2-1 backup strategy refers to having at least 3 copies of your data, 2 of which are with you at the house on different devices, and at least a copy is offsite.

- Cloud Backups. Another option is to go with cloud-based storage for some documents. Many cloud-based solutions allow access through mobile devices, making your documents accessible almost anywhere. If you upload your documents as they are, be cautious about what you upload. Your files can be lost, corrupted, hacked, intentionally removed, or read by the cloud vendor’s employees. You will have more leeway if you encrypt your data before uploading or choose a vendor that offers privacy and encryption by default. Some options to get you started in your research include the following:

- Amazon Cloud Drive

- Apple iCloud

- Backblaze

- Box

- Carbonite

- Dropbox

- Google Drive

- iDrive

- Microsoft OneDrive

- NextCloud

- Digitizing Paper Copies. Your scanner or phone camera can help you digitize your life with ease. Don’t enable auto upload through your scanner’s software or cloud storage if you go this route. Keep your scans and pictures local if you can. Also, make sure you don’t need a physical copy or original document in the future after scanning. The last thing you want to do is shred something to save space, only to realize you need it later.

How to Discard Your Documents

If you don’t already own a crosscut shredder, it’s time to buy one. Not only will you get your money’s worth, but you’ll also have the peace of mind of knowing no one can piece the documents together.

Recommended option: Amazon Basics 15 Sheet – New model Cross Cut Paper and Credit Card CD Shredder With 6 Gallon Bin

If you don’t shred your documents, you’ll risk fraud or identity theft if you simply throw away private documents. You may not even realize how much information is present on your old bills, statements, voided and canceled checks, and other financial documents.

Here’s what could be present on the documents you want to throw away:

Potential Identifying Information

- Full names

- Physical addresses

- Phone numbers

- Account and routing numbers

- Driver’s license numbers

- Social Security Numbers

- Policy numbers

- Usernames and Passwords

- Membership information

- Medical records

- Signatures

Example Documents to Shred

- ATM receipts, voided checks, PIN mailers, deposit slips, Bank statements

- Brokerage and investment accounts

- Birth certificate copies and other health records

- Credit card statements, bills, and offers

- Expired IDs and payment cards

- Employment documents and paystubs

- Travel itineraries, boarding passes, and luggage tags

- Mortgage statements and utility bills

Your best option is to shred any documents that contain sensitive information before throwing them out. We also like to add our junk mail and other important documents to the scanner to make it even more challenging to piece together important information.

Additional Options for Shredding Documents

If you’re adamant about not getting a shredder for whatever reason, you can use a professional shredding service. You will likely have to pay a fee for this service, but if you don’t have a shredder or are in an extended stay somewhere else, it’s a small price to keep your personal information safe.

Some retail options for shredding services include:

- FedEx Centers

- Office Depot

- Office Max

- Staples

- The UPS Store

And finally, many cities and communities have free paper shredding days for residents. The time can vary based on locale, but you’ll usually see something in the spring for Spring Cleaning. Check your city or community’s website for more information.

Keep Your Financial Documents and Future Safe

Managing your life and personal finances means dealing with a ton of paperwork like bank statements, insurance documents, and tax materials. But don’t let them pile up! Figuring out what to keep and for how long, and what to toss will save you space and stress in the long run.

By understanding how long to keep your financial documents and other personal records, you are taking steps to protect your financial security. These documents help make up your history and current profile.

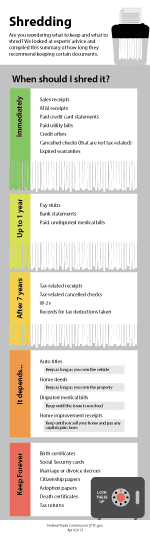

Here’s a handy shredding infographic from the FTC for a nice reminder.

If you have records or documents you aren’t sure you’ll need, keep your financial documents until you are positive you don’t need them anymore. It’s better to err on the side of caution and have them and not need them than need them and not have them.

However, knowing how long to keep your financial documents is a small step in ensuring your finances are in order. You need to develop a system to protect you in the downtimes and improve your overall position. This helps increase earnings and puts you in a better position to bolster your security and privacy.

To learn more about personal finance to securely build a system that works for you, check out the book I Will Teach You To Be Rich by Ramit Sethi. It’s one of our top recommendations for getting your personal finances in order. It has over 10 years of battle-tested results by many people with different backgrounds.