If you have a student loan balance, you may have noticed the one-time student loan debt relief order on August 24, 2022.

This order reduces $10,000 or $20,000 in student loan debt relief for eligible holders, assisting up to 40 million borrowers.

The U.S. Department of Education (DoE) will provide up to $20,000 in debt relief to Pell Grant recipients with loans held by the DoE and up to $10,000 in debt relief to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 or $250,000 for households.

The relief is capped at the amount of your outstanding debt. Additional payments will not be made to you if you have already paid off your loans or your outstanding loan amount is less than your eligible payment.

There were also adjustments for borrowers with past loan periods towards loan forgiveness under income-driven repayment (IDR) plans and Public Service Loan Forgiveness (PSLF). To learn more about the proposed changes, head over to the Student Debt Relief Plan Announcement explanation page.

Table of Contents

Beware Of Student Loan Relief Scams

It didn’t take long after the announcement for criminals to jump on this activity. You may be contacted by a criminal or less than legitimate company saying they can offer assistance to get your loan discharged, canceled, or forgiven for a fee.

These scams also offer debt relief payments in high amounts for a fee. Don’t fall for these scams!

You never have to pay for help with your federal student aid. Ensure you work only with the U.S. Department of Education and the designated loan servicers. Never reveal personal, financial, or account information to anyone.

Official student loan emails come from:

You can report scam attempts to the FTC by calling 1-877-382-4357 or visiting reportfraud.ftc.gov.

First Student Loan Debt Relief Email From DoE

Here’s the exact email from the DoE:

Subject: Apply Now for Student Loan Debt Relief!

From: U.S. Department of Education <[email protected]>

Sent: October 26, 2022

YOUR NAME,

The Student Loan Debt Relief Application is available! As part of the Biden-Harris Administration’s one-time student loan debt relief plan, you can apply NOW for relief of up to $20,000.

Filling out the application is easy and takes about five minutes. You don’t need to log in or provide any documents. The application is available in English and Spanish and works on both desktop and mobile devices.

If you already applied and received a confirmation email, you don’t need to re-apply.

To find more information about eligibility, visit the student loan debt relief page.

One-Time Student Loan Debt Relief Application

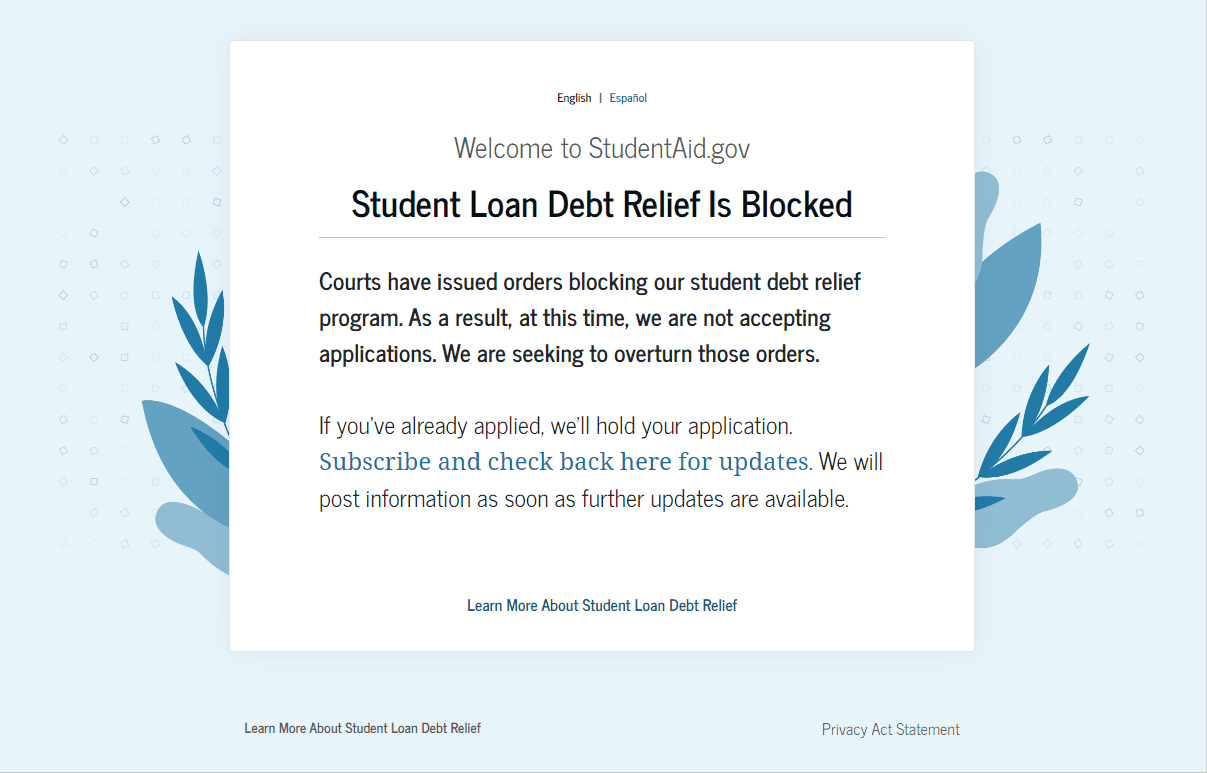

The application page allows you to sign up for a one-time student loan debt relief in 5 minutes or less if they have your information from your filed taxes. Some folks have received the relief, but the program is currently paused pending litigation.

Here’s the info from the application page:

Application is open, but debt discharge is paused.

As a result of a court order, we are temporarily blocked from processing debt discharges. We encourage you to apply if you are eligible. We will continue to review applications. We will quickly process discharges when we are able to do so and you will not need to reapply.

Confirmation Of Your Federal Student Loan Debt Relief Application

After you complete the application, you will be sent to the application confirmation page, and a follow-up email with the same information will be sent.

Here’s that exact info:

Subject: Confirmation of your federal student loan debt relief application

From: [email protected]

Thank you! Your application for one-time federal student loan debt relief has been submitted.

We’ll send you an email to confirm we received your submission.

Next Steps

1. We’ll process your application

We’ll review your application, determine your eligibility for debt relief, and work with your loan servicer to process your relief. Unless you hear back from the U.S. Department of Education or your loan servicer, you don’t have to take any other action.

2. We’ll contact you if we need additional information

We may need additional information from you to process your application. If we do, we’ll contact you by email with additional instructions. The following are examples of situations where we’ll follow up with you:

- We need additional documentation from you to verify your income.

- If you were enrolled as a “dependent student” anytime between July 1, 2021 and June 30, 2022, we may need information about your parents’ income.

- We cannot match you to our loan records based on the information provided in your application.

3. We’ll keep you updated along the way

We’ll notify you when your application has been approved and sent to your loan servicer to process your debt relief. Your loan servicer will notify you when your debt relief has been applied and will share any additional information, such as updates to your outstanding loan balance and updated monthly payment amount (if you still have a balance).

4. Get more information about student loan debt relief

For additional details on student loan debt relief—including how debt relief will be applied to your loans—go to the student loan debt relief page.

Update Email On November 22, 2022

The Student Loan Debt Relief application has been closed.

The email discusses why the application was closed and why the relief payments have paused. Here’s the exact email:

Subject: Your Student Loan Debt Relief Application Has Been Approved

From: Secretary of Education Miguel Cardona <[email protected]>

From Secretary Cardona: Lawsuits are preventing the U.S. Department of Education from implementing its one-time student loan debt relief program

YOUR NAME,

This email provides you with an update on the one-time Student Loan Debt Relief plan that President Biden and I announced on August 24th.

We received your application or have the income information to process you for loan relief. You do not need to take any further action at this time.

Unfortunately, a number of lawsuits have been filed challenging the program, which have blocked our ability to discharge your debt at present. We believe strongly that the lawsuits are meritless, and the Department of Justice has appealed on our behalf. We will keep your application information and will continue our review of your eligibility if and when we prevail in court. We will update you when there are new developments.

The Biden-Harris Administration is committed to helping borrowers as they recover from the pandemic.

Education is a great equalizer, and we will never stop fighting for you!

In Service,

Miguel A. Cardona

U.S. Secretary of Education

Update Email on December 13, 2022

There was a follow-up email addressing the subject line of the last email. Here’s the exact email:

Subject: CORRECTION: Status of Your Student Loan Debt Relief Application

From: U.S. Department of Education <[email protected]>

CORRECTION: Status of Your Student Loan Debt Relief Application

Due to a vendor error, you recently received an email with a subject line indicating your application for the one-time Student Loan Debt Relief Plan had been approved. The subject line was inaccurate. The body of the previous email was accurate.

We have received your application but are not permitted to review your eligibility because of ongoing litigation. We will keep your application information and review your eligibility if and when we prevail in court.

We apologize for the confusion, and you do not need to take any further action at this time. We will keep you updated with any developments.

Conclusion

It’s essential to remain vigilant against scams. That’s why we teach personal finance principles along with standard security awareness principles. Lack of time and desperation for money can be a bad combo for effortlessly falling into a criminal’s trap, even if it’s accidental.

Keep an eye on the official status of the student loan debt relief news. Still, it’s probably wise to move forward with the expectation that this will most likely not move forward without the approval of Congress, the body that approves and spends the money.